Takeaways From the IRS’s Latest Data Book

Unpacking the latest package of tax statistics.

The Internal Revenue Service (IRS) released its annual “Data Book” last week, unlocking some interesting insights into the nation’s tax base. While ministries and religious 501(c)(3) nonprofits are exempt from paying income tax, they’re still obligated to file information returns with the IRS.

IRS building photo (public domain)

Still, tax-exempt nonprofits aren’t immune to certain collections, namely when they receive funds from a trade or business unrelated to the organization’s charitable purpose as designated by the IRS. This tab, including penalties and interest, accounted for less than .05% of all IRS collections last year, totaling $1.9 billion. That’s a steady increase from the $1.4 billion collected in 2022, $1.1 billion in 2021, and $943 million in 2020.

Zooming out to the national picture: The IRS processed more than 271.4 million tax returns and collected $4.7 trillion overall, with 88% paid by individuals and estates/trusts or employment taxes. Business income taxes represent 9.7% ($456 billion).

Here are some other highlights from the 2023 Data Book:

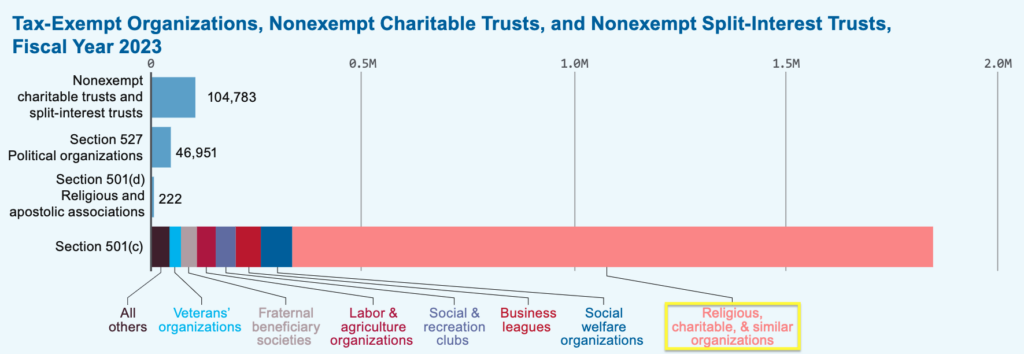

1.5M Religious Ministries, Charities & Other Nonprofits

The IRS received 1.78 million filings from tax-exempt organizations in 2023, up 2.2% from 2022’s 1.75 million.

The agency lumps religious, charitable, and similar organizations like private foundations into one subcategory recognized through Section 501(c)(3) of the tax code. This population topped 1.5 million last year, growing slightly from 1.48 million in 2022 and 1.43 million in 2021. It’s always the largest subcategory of 501(c) organizations, totaling 1.84 million in 2023. Another 222 are classified as 501(d) religious and apostolic organizations.

IRS Data Book

The topline statistics exclude religious-tied organizations that aren’t required to apply for 501(c)(3) recognition. Otherwise, the pool would be much wider, considering countless churches, interchurch units, integrated church auxiliaries, conventions, associations, and organizations with under $5,000 in gross receipts.

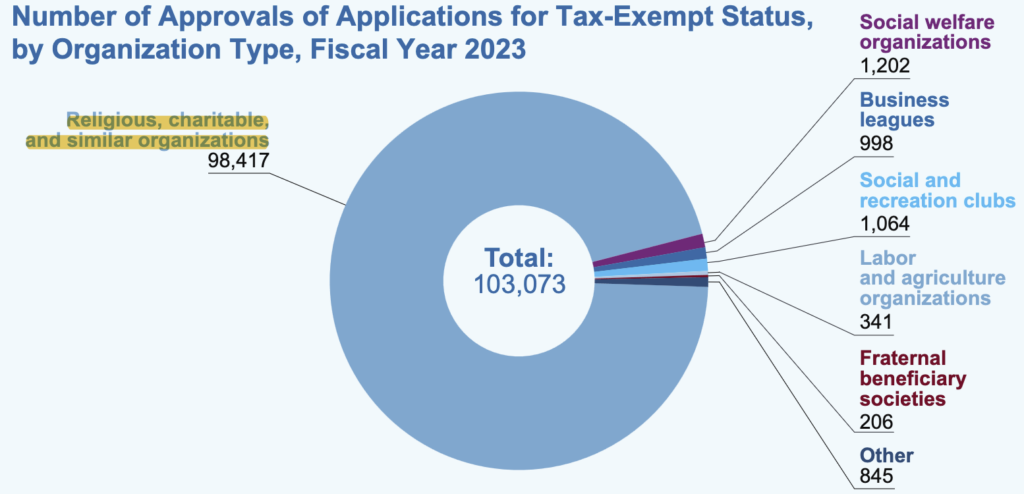

Application Approvals Fall by 17,000

The religious and charity category is typically the busiest subgroup applying for tax-exempt status in any given year. However, the IRS only approved 98,417 such applications in 2023, a notable drop from 115,506 in 2022 but nearing the 78,991 average between 2020 and 2021.

IRS Data Book

Overall, the IRS approved 86% of all tax-exempt bids (103,073) and closed 119,491 applications. Most rejections (62 of 88) were from religious groups, charities, and similar organizations. Another 15,594 are labeled “other,” meaning those withdrawn, incomplete or otherwise lacking the required information.

Audits Decline, Especially in Unrelated Business Income Tax

As in previous years, audits of tax-exempt organizations were sparse in 2023, totaling 7,666 filings. About 1,020 were information returns in the main Form 990 series, down from 1,343 in 2022 and 1,383 in 2021.

The IRS also examined 268 Form 990–T returns regarding unrelated business income tax. This is a significant downslide from the 668 reported in 2022 and 748 in 2021. Form 4720 returns, which report excise taxes on exempt organizations and individuals, drew 231 examinations compared to 292 in 2022 and 301 in 2021.

The agency assessed 813,916 civil penalties from excise taxes and tax-exempt organizations/trusts, racking up $992 million. Most resulted from failure to pay (about 421,000 totaling $47 million), followed by delinquency (over 248,500 or $106 million) and daily delinquency (68,545 or $303.8 million).

Main photo: IRS building photo (public domain)

TO OUR READERS: Do you have a story idea, or do you want to give us feedback about this or any other story? Please email us: [email protected]