IRS Finalizes Tax on Non-Profit Organizations with Million Dollar Salaries

The IRS has finalized its rules on an excise tax to discourage excessive compensation at non-profit organizations. In its February 16th Bulletin, the IRS announced an update to section 4960 of the Internal Tax Code taxing non-profit organizations and churches that pay “covered employees” more than $1 million in wages or provide excessive “golden parachute” payments.

The Bulletin explains that a covered employee “is one of the five highest-compensated employees of the organization…” These individuals are typically listed on a Form 990 filed with the IRS. Churches, synagogues, and mosques are exempt from filing the financial disclosure document.

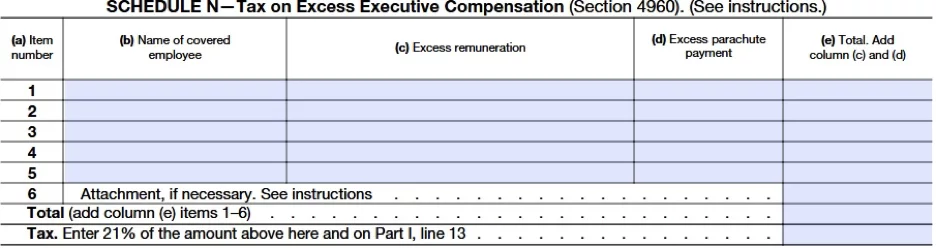

When covered employees, who are often executives, receive more than $1 million in wages or excessive parachute payments, the non-profit must file a Form 4720 Schedule N. Then the non-profit organization must pay a 21 percent tax on the excessive compensation.

In 2018, the IRS modified the Form 990, revealing if organizations have paid an excise tax on payments of more than $1 million. Excise payments are indicated on page 5, line 15 of the Form 990.

![]()

Trinity Foundation examined MinistryWatch’s list of highly paid compensated ministry leaders and determined that Inspirational Network, High Point University and Educational Media Foundation (K-Love) pay the excise tax.

Hillsdale College and Glory of Zion International (Chuck Pierce) so far do not report paying the excise tax even though both feature an executive receiving more than $1 million in compensation. This is not proof of wrongdoing because some compensation is exempt from the excise tax such as an organization carrying liability insurance on an employee.

This excise tax penalizes excessive wages, not fees. If a pastor is paid to perform a wedding, the income is considered a fee and would not be subject to an excise tax.

Besides excessive wages, the IRS also treats parachute payments as a form of excessive compensation.

After Jerry Falwell Jr. resigned from Liberty University last year, journalists reported the disgraced university administrator could receive $10.5 million in parachute payments.

According to The Wall Street Journal, “Mr. Falwell is due his $1.25 million salary for two years, followed by a lump-sum payment of about $8 million, because of a clause in his contract that allowed him to resign with full pay if his responsibilities were curtailed.”

Trinity Foundation estimates Liberty University will pay a tax penalty of $1,530,383 on golden parachute payments of $10.5 million.

Future Form 990 filings by Liberty University will show whether or not an excise tax is paid on the parachute payments.

This article ran at The Trinity Foundation. This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.