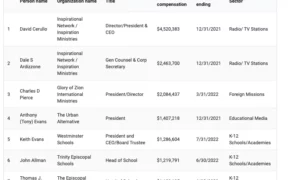

Inspiration Ministries, YMCA of the USA, EMF (K-Love), American Center for Law & Justice have greatest number of execs on list

Below is a list of 100 highly paid Christian ministry executives. The information was derived from the latest available Form 990 prepared by the ministry itself.

But Covid-induced backlog persists

The IRS is still working through a hefty backlog of tax filings delayed after the COVID-19 pandemic, but recently released more than 1 million returns from tax-exempt organizations.

If you didn’t get a chance to read our article on Bishop Scott Jones, who recently left the United Methodist Church, I recommend it to you.

Colorado Springs already had hundreds of churches, but the IRS says it now has one more.

Saddleback Church, the megachurch long led by Rick Warren, has been ousted from the Southern Baptist Convention for naming a woman to its pastoral team.

ECFA Membership Changes, MinistryWatch Database Changes, What’s on the Podcast? On This Date at MinistryWatch

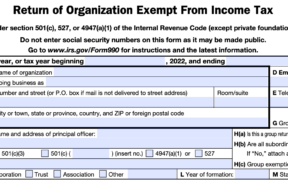

How To Read A Form 990. This webinar has proven so popular that we’ve repeated it three or four times over the past two years. And we’re going to do it again. ...

ECFA Membership Changes, MinistryWatch Database Changes, What’s on the Podcast? On This Date at MinistryWatch

ECFA Membership Changes, MinistryWatch Database Changes, What’s on the Podcast? On This Date at MinistryWatch

As Americans scrambled to make their year-end charitable contributions, they may have to do so without a key tool for understanding how those charities spend their money: their most recent tax forms.

UMC Denial, Episcopal Church Meltdown, Highly Paid Ministry Executives, and…THANKS!

ust weeks ago, 487 United Methodist churches were approved for disaffiliation from the denomination, bringing the total of ratified exits to 1,314. Hundreds more have already voted to exit and are awaiting final approval.