IRS Releases Batch of Delayed Nonprofit Filings

But Covid-induced backlog persists

The U.S. Internal Revenue Service (IRS) is still working through a hefty backlog of tax filings delayed after the COVID-19 pandemic. But the agency has eased the logjam to some extent, recently releasing over 1 million returns from tax-exempt organizations.

ProPublica reported earlier this month that the latest batch covers over 900,000 filings from recent years (mostly 2020 to 2022) and another 400,000 from 2016 and 2017. Though most nonprofits are exempt from income taxes, they’re typically required to submit an annual Form 990 information return, a record of the last year’s revenue/contributions, expenses, executive pay, and core activities.

Up-to-date Form 990s are an essential knowledge base for nonprofit donors, so the years-long delays have effectively dealt a blow to transparency efforts. This also impacts the country’s base of tax-exempt religious, charitable, and similar organizations, the largest subcategory of the nonprofit sector, comprising 1.48 million organizations as of 2022.

Overall, tax-exempt organizations filed 1.75 million returns in 2022, according to the IRS’s latest Data Book. Churches and religious organizations generally aren’t subject to Form 990 reporting obligations, but many file them anyway to keep donors informed.

It’s unclear exactly how many Form 990s have yet to be processed. MinistryWatch asked the IRS to quantify this shortfall and supply an estimated timeline for when its records will be current. The agency provided this statement: “The IRS continues to work hard to get through the inventory of Form 990 returns. All electronic and paper returns for tax year 2021 or earlier that did not require further review or correction have been processed. Returns received prior to January 2023 that need to be reviewed or corrected are still being processed. IRS is opening mail within normal time frames.”

The IRS periodically posts completed filings publicly via its Tax-Exempt Organization Search Tool, which currently displays a notice that it’s still processing paper-filed 990s received in 2021 and later.

(Source)

The same webpage marks Aug. 25, 2022, as the latest data update for Form 990-series returns. However, other relevant tax-exempt records were posted as recently as May 2023, including Form 990-N filings (electronic notices by small organizations with less than $50,000 in receipts), Pub. 78 data (a list of organizations that receive tax-deductible contributions), and auto-revocation (organizations whose tax-exempt status was revoked for failing to file Form 990-series returns).

Pandemic-Induced Backlog

Nonprofits aside, the IRS’s backlog of all tax returns is far from resolved. Per a recent update on its website, 3.8 million individual returns remain unprocessed as of June 3, including 2022 returns, 2021 filings needing review/correction, and late-filed prior-year returns.

This marks some progress from the peak of the delays. At the end of the 2021 tax season, 35.3 million returns awaited manual processing. And by March 2022, the paper backlog topped 15 million, mostly individual and business tax returns.

Today, the IRS hasn’t fully recovered from pandemic-related disruptions to its normal operations and staffing. Since 2020, it has faced mounting pressure to mend the delays by Congress and the Taxpayer Advocate Service (TAS), its own independent watchdog. TAS’s 2023 Objectives Report to Congress in June 2022 said the IRS’s paper backlog outsized that of the previous year, and its pace of processing returns was slowing.

According to TAS, many of the IRS’s challenges come down to inadequate staffing, including gaps in call centers and submission processing. Still, with 79,070 full-time equivalent employees in 2022, the agency’s workforce has increased by 5,500 since before the pandemic in 2019. With $80 billion in new funds from the Inflation Reduction Act, it plans to hire over 10,000 employees by the end of 2023 and 10,000 more in 2024.

Access to MinistryWatch content is free. However, we hope you will support our work with your prayers and financial gifts. To make a donation, click here.

Outdated Technology and Budgetary Gaps

In addition to staffing, the ongoing delays also stem from longstanding technology deficiencies across the IRS’s everyday activities. For example: Lacking sufficient scanning systems, employees must re-type the numbers from each paper-filed return. The agency is looking to exit that status-quo with its “Digital Intake” initiative, which launched earlier this year by scanning 120,000 paper Form 940s, with plans to expand to Forms 1040 and 941.

This is just one area needing modernization. TAS recently listed a host of outdated processes, including 60 separate case management systems that aren’t integrated and generally don’t communicate with each other.

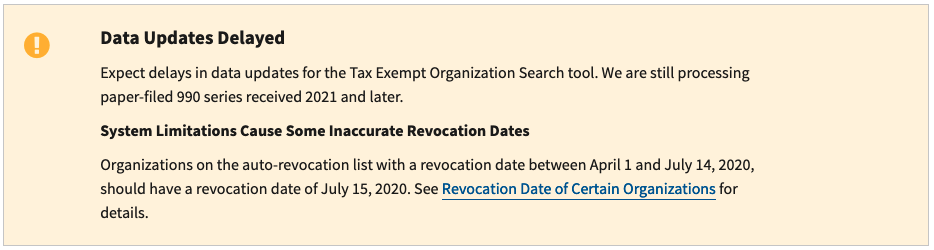

Only a tiny portion of the IRS’s budget serves its business systems modernization (BSM) account, which funds new information technology systems. In increasing the budget by nearly 6% in 2022, Congress appropriated $275 million for BSM, while the other three funds received $12.3 billion for core services, enforcement, and operations support. This share was also $30 million less than the $305 million it initially requested for BSM improvements like replacing legacy code established nearly 60 years ago, building a common cloud infrastructure and automating business functions, adding web applications for taxpayers and professionals, and other projects.

Source: page 69 (highlights added by MinistryWatch)

Ultimately, of the $14.3 billion in operating costs the IRS racked up last year, only $414 million funded BSM activities. Comparatively, 37.9% was spent on enforcement activities, 36.1% on operations support, and 23.1% on core taxpayer services.

Main photo: Photo of a Form 990 / Source