IRS Backlog is a Blow to Transparency Efforts

Almost 11 weeks into tax season, the U.S. Internal Revenue Service continues to experience delays in processing last year’s tax returns. Millions of tax returns and filings are still backlogged, including those in the Form 990 series, an annual reporting obligation by tax-exempt entities, including Christian ministries.

Like the operational bottlenecks impacting bureaucracies everywhere, the root issues behind these delays trace back to early 2020 when the IRS shut most of its offices and taxpayer assistance centers, discontinued face-to-face interactions, and suspended its phone help lines. Operations have mostly resumed since then, but the agency still isn’t caught up.

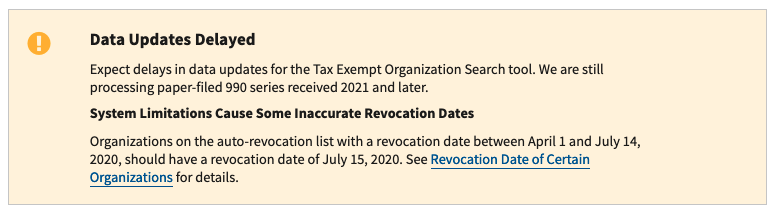

As of March 18, the IRS’s paper backlog topped 15 million, including 9.6 million individual and business tax returns, 1.3 million returns that the IRS hasn’t yet classified, and 3.8 million amended returns. It’s unclear how many filings are delayed for tax-exempt organizations in particular. MinistryWatch posed this question to the IRS’s media office but did not receive an answer ahead of publication. Nevertheless, the IRS’s website currently displays notices about delays in processing Form 990s and issuing some notices to tax-exempt entities.

This means some organizations that have met every filing deadline still don’t have their Form 990s made public on the IRS’s website. The latest documents accessible via the tax-exempt organization search tool were filed in 2020 or earlier. Since many organizations end their fiscal year on June 30 and have several months to submit their Form 990s, the latest available filings cover activities that happened in 2019—almost three years ago.

To give a sampling: the top five ministries ranked in MinistryWatch’s database by their intake of contributions—including World Vision, Compassion International, Catholic Relief Services, and Food For The Poor—appear in the IRS search system with Form 990s dating back to 2019 or earlier. One exception is Samaritan’s Purse, whose 2020 Form 990 is live on the site.

As a result, donors are missing out on critical information to gauge a nonprofit’s revenue and expense patterns. This prevents existing donors from knowing how their money is being spent and impedes prospective donors from making fully informed giving decisions. According to a Giving USA Foundation report, 2020 was the highest year of charitable giving on record with $471.44 billion given to U.S. charities, including $131.08 billion in religious contributions. But with trust in nonprofit groups declining, and inflation and other economic pressures disrupting consumer spending behaviors, it’s unclear if that momentum will continue.

In another issue, the IRS’s statistical data is lacking when covering the tax-exempt sector. Most of its data reports on tax-exempt organizations are dated 2018 and earlier. Beyond that, the ongoing backlogs impact the IRS’s Data Book, an annual publication outlining all the activities, collections, returns, enforcement actions and more critical functions the agency has undertaken in the past year. The most recent edition was published last June and covers activities from October 2019 to September 2020. But as of this writing, the 2021 release schedule still reads “pending.”

That being said, based on the 2020 Data Book, we know 1.3 million Form 990 filings were submitted in 2020, a 14.4% drop from 2019. As for enforcement, the agency examined (audited) 11,160 tax-exempt returns, including those in the Form 990 series. The IRS also closed 95,864 applications for tax-exempt status, 89.2% of which were approved. But this process has since been delayed, with the IRS website stating that some applications postmarked after June 2021 haven’t yet been assigned.

Access to MinistryWatch content is free. However, we hope you will support our work with your prayers and financial gifts. To make a donation, click here.

A recent directive from the Taxpayer Advocate Service, an independent oversight body within the IRS, criticized the agency for its extensive backlogs and outdated data entry processes. Despite many state-level tax units adopting scanning systems to automate paper returns, the IRS still has the two oldest IT systems in the federal government, dating back to the 1960s.

In its 2021 report to Congress, the Taxpayer Advocate Service highlighted excessive processing and refund delays as one of the most severe problems encountered by taxpayers last year. Aside from the obvious COVID-induced disruptions and increased workload from distributing tax relief and economic impact payments, the IRS’s root problems are more chronic in nature: From 2010 to 2021, the agency’s budget declined by nearly 20% and it lost over 33,000 full-time employees.

While this year’s budget of $12.6 billion is a 6% jump from 2021, it’s short of what the IRS needs to address the current paper inventory issues and support its IT operations. Plus, IRS Commissioner Charles Rettig said in March that over the next six years, the agency would need to hire 52,000 employees just to maintain its current levels. To cope with ongoing delays, the IRS recently announced plans to hire 10,000 workers within the next year.

Still, IRS leadership believes the shortfalls will be temporary. Rettig stated to the House Oversight Committee last month, “As of today, barring any unforeseen circumstances—COVID, etc.—and if the world stays as it is today, we will be what we call ‘healthy’ by the end of 2022 and enter the 2023 filing season with normal inventories.”