IRS Increases Tax Rates for Noncommercial Aircraft Flights

The change is likely to impact personal flights taken on ministry-owned aircraft.

A new rule change from the Internal Revenue Service (IRS) would increase the tax rates for noncommercial flights on employer-owned aircraft. The Trinity Foundation, a Dallas-based ministry watchdog group, reported that the change would impact personal flights taken on ministry-owned aircraft.

Considered “fringe benefits” under the Internal Revenue Code, these flights are valued using the Standard Industry Fare Level (or SIFL) formula, which multiplies the cents-per-mile rate and adds the relevant terminal charge calculated by the Department of Transportation.

In its rule change summary, the IRS noted that the COVID-19 pandemic caused airline industry capacity to decline faster than expenses were reduced. Typically, the SIFL rate divides airline expenses by capacity, but since the pandemic triggered a massive reduction in the latter, the SIFL rate increased substantially.

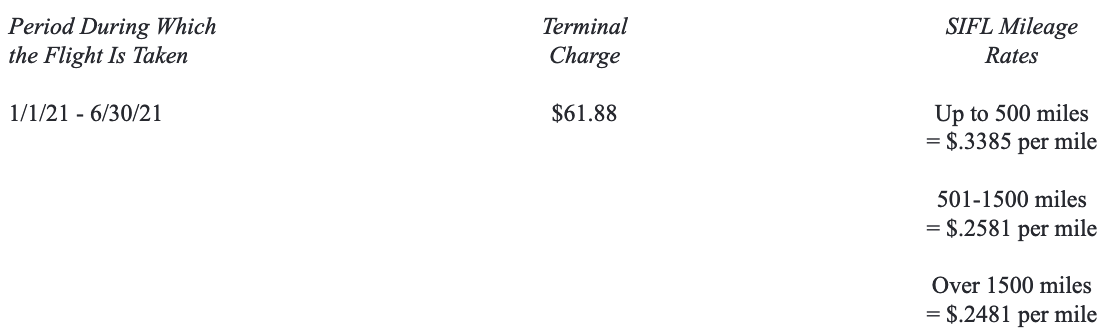

The IRS’s new rate marks a significant increase from last year’s rates for flights dated July 1 to Dec. 31. It includes a $61.88 terminal charge (up from $42.62 in the second half of 2020), with mileage rates starting at 33 cents per mile for flights up to 500 miles (up from 23 cents per mile), 25 cents per mile for flights between 501 and 1,500 miles (up from 17 cents per mile), and 24 cents per mile for flights up to 1,500 miles (up from 17 cents per mile).

Source: IRS Internal Revenue Bulletin

The IRS also included another rule change to account for the $25 billion in payroll grants and promissory notes provided to domestic carriers via the Payroll Support Program (PSP), authorized by the $2.2 trillion Coronavirus Aid, Relief and Economic Security (CARES) Act in March 2020. During that time, the Department of Transportation provided a way for filers to incorporate PSP funding into the SIFL rate calculations.

Accounting for COVID-19 relief, the new rates are as follows:

- SIFL rate adjusted for PSP grants: $44.35 terminal charge; 24 cents per mile for flights under 500 miles; 18 cents per mile for flights between 501 and 1,500 miles; 17 cents per mile for flights over 1,500 miles

- SIFL rate adjusted for PSP grants and promissory notes, with a $38.03 terminal charge and 20 cents per mile up to 500 miles, 15 cents per mile for flights between 501 and 1,500 miles, and 15 cents per mile for flights over 1,500 miles).

The IRS says taxpayers can use any of these rates when determining the value of noncommercial flights on employer-provided aircraft between Jan. 1 and June 30 of this year.

Access to MinistryWatch content is free. However, we hope you will support our work with your prayers and financial gifts. To make a donation, click here.

Some televangelists disclose their air travel expenses on their Form 990 filings. For example, the Christian television network Trinity Broadcasting of Florida, which owns a Bombardier Global Express jet, reported $6.8 million in airline depreciation expenses on its 2019 Form 990, including $192,256 for travel, $1.7 million for rental expenses, and $4.9 million for affiliates.

Still, televangelists rarely disclose the cost of their jets to donors. Last year, the Trinity Foundation examined Federal Aviation Administration aircraft registry listings and found that several ministries acquired high-priced jets, including Jesse Duplantis’ Voice of the Covenant World Outreach Center, Al Denson’s Celebration Ministries, Tracy Harris’ Harvest International Ministries, and Mac Hammond’s Living Word Christian Center.