Church Subsidiaries Protect Assets, but Complicate Accountability

Ministries are forming LLCs under their tax-exempt status, making it nearly impossible to hold leaders accountable.

Churches that want to reach beyond their congregations are forming nonprofit and for-profit subsidiaries to separate church-related projects and protect assets. As pastors, churches, and ministries adopt business strategies to grow members, income, and value of assets, the need for accountability is increasing.

Creating subsidiaries, while compliant with IRS regulations, often makes an organization less transparent to donors. The strategy can protect ministries from liability, but it sometimes turns the ministry into a brand, the pastor into a CEO, and its members into customers.

Hillsong Church USA’s corporate counsel and attorney Stephen Lentz writes in his book “The Business of Church” that “we live in a litigious society,” and because of that, churches should create non-profits and single-member limited liability companies (LLCs) to protect the church and its assets from liability.

Lentz also advises the Association of Related Churches (ARC) and is the father of former NYC Hillsong celebrity pastor Carl Lentz.

Lentz’s book explains how pastors can use LLCs to own their intellectual property, including books, programs, and talks. Televangelists and pastors with large media ministries can then license those “products” to a church or ministry. The pastor may also charge consulting fees paid to the LLC.

In April, MinistryWatch reported on the lucrative honorarium strategies of several US ministries. Many of the ministries own subsidiaries, often filed under the church or ministry as “integrated auxiliaries” that get the same tax exemptions. The IRS doesn’t require integrated auxiliaries to file for tax-exempt status (Form 1023), annual returns (Form 990), or file tax returns upon dissolution.

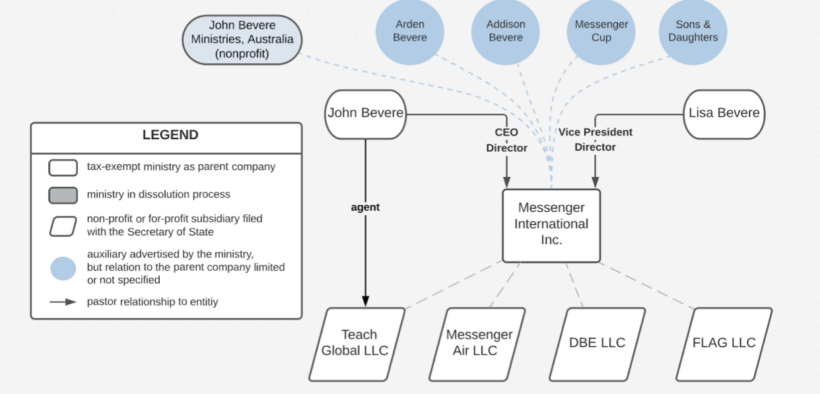

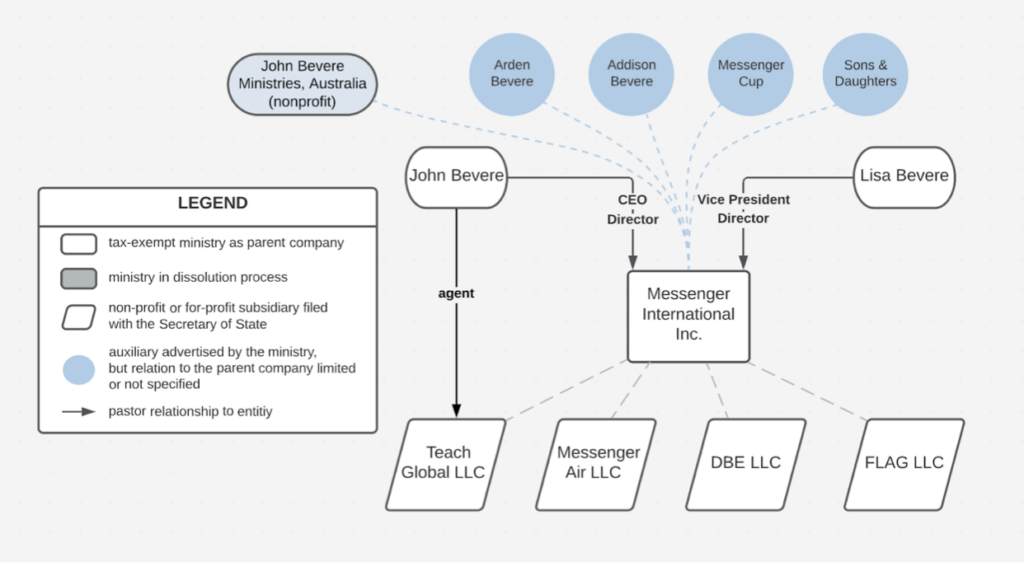

Messenger International/John and Lisa Bevere

Messenger International Inc. was incorporated in 1992 by John & Lisa Bevere. John is listed as CEO and director, while Lisa is listed as vice-president and director.

Auxiliaries of Messenger International include Teach Global LLC, Messenger Air LLC, DBE LLC, and FLAG LLC. Messenger is also the parent company of the Messenger Cup, Sons & Daughters, and both Addison and Arden Bevere’s ministries. John Bevere also owns John Bevere Ministries in Australia.

Although most of the subsidiaries share the ministry’s head office address in Palmer Lake, Colo., Messenger International is registered in Florida.

Messenger consolidates its spending in a public financial report but does not disclose salaries, housing allowances, or retirement benefits information. The most recent report (2020 and 2021) does not mention DBE LLC, an auxiliary registered in Franklin, Tennessee.

Access to MinistryWatch content is free. However, we hope you will support our work with your prayers and financial gifts. To make a donation, click here.

In a spotlight article last August, MinistryWatch reported that John and Lisa Bevere, as well as other family members, are paid executives for Messenger and earn revenue from royalty, curriculum, and book sales through LLCs.

They also receive honorariums, housing allowances, and personal services paid for by Messenger International.

Messenger has been a member of the Evangelical Council for Financial Accountability (ECFA) since 2011. However, the ECFA does not disclose details on salaries, benefits, or housing allowances, and there is little specificity regarding subsidiaries.

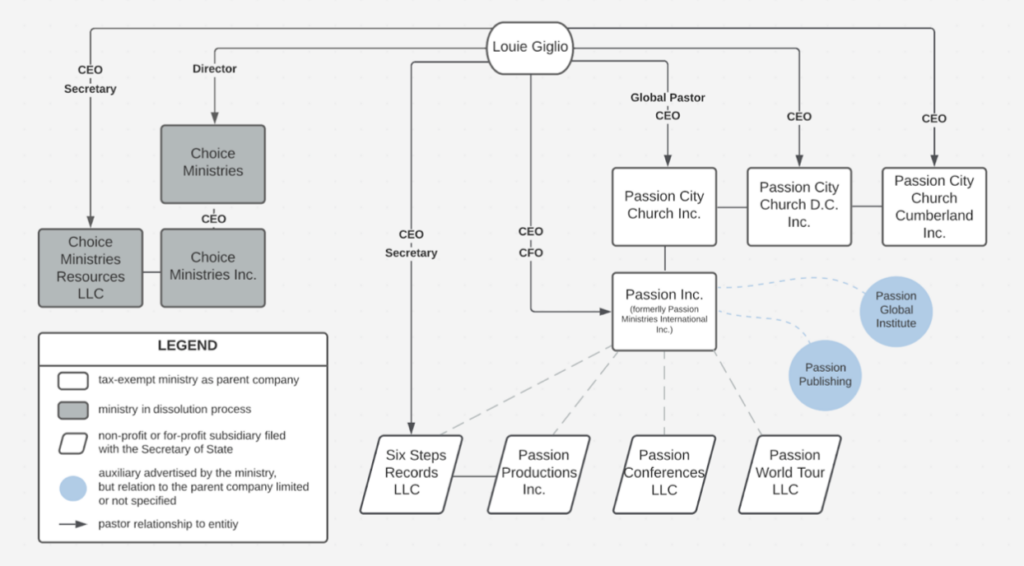

The Passion Movement/Louie Giglio

Louie Giglio is CEO of Passion City Church Inc. in Atlanta, Georgia, Passion Inc., Passion Productions Inc., Passion Conferences LLC, Passion World Tour LLC, and Six Step Records LLC

. His wife, Shelly, is a co-founder of the Passion enterprise and holds several titles at Six Step Records.

Since all Passion ministries are funneled through Passion City Church and Passion Inc., there are no outward checks and balances of the auxiliary’s stewardship.

However, Passion City Church released a 2022 Impact Report that disclosed $4,368,000 in “above and beyond” donations (those “given above and beyond tithes offerings”). The report says it gave $2 million to partners and distributed the rest to church campus projects.

The report does not provide financial details of its other ministries.

Giglio is also listed as CEO or director of Choice Ministries (nonprofit), Choice Ministries Inc., and Choice Ministries Resources LLC, but these may be in dissolution.

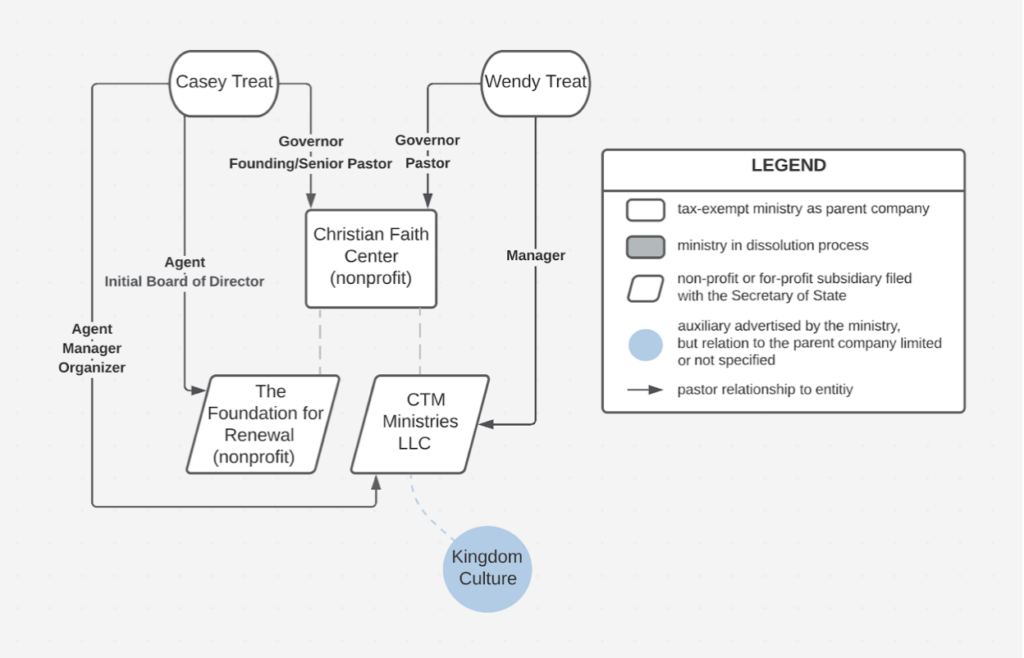

Christian Faith Center/Casey Treat Ministries

Casey Treat founded The Christian Faith Center in Federal Way, Washington. Treat promotes his program, “Kingdom Culture” via caseytreat.com where donations go to CTM Ministries LLC, headquartered 1,500 miles southeast in Arizona.

Treat has owned several non-profits, and his bio says he is founder and president of Vision College (formally Dominion), but Vision became Seattle Bible College in 2011. Treat opened Foundation for Renewal earlier this year.

Free Chapel Worship Center/Jentezen Franklin

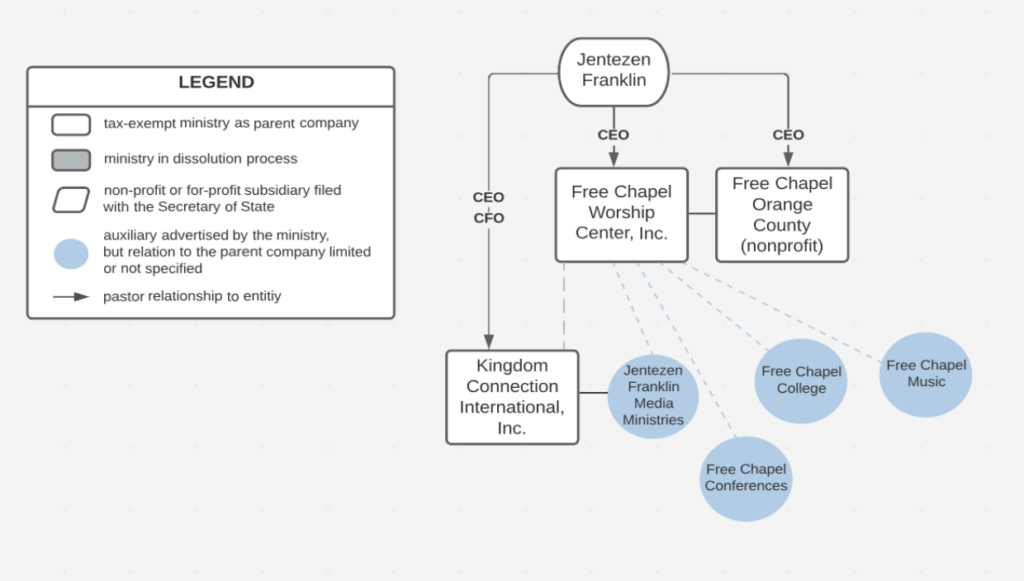

Jentezen Franklin, lead pastor and CEO of Free Chapel Worship Center in Gainesville, Georgia, and Free Chapel Orange County California, is also CEO and CFO of Kingdom Connection International, Inc.

Free Chapel’s website advertises its conferences and college, while Franklin promotes his books, podcast, and television program on a self-titled website that lists “Jentezen Franklin Media Ministries” as the destination of gifts.

Free Chapel does not report 990s but has shared general financial information with the ECFA since 2012. ECFA’s most recent report (2021) lists $81 million in revenue.

Franklin’s ECFA profile lists multiple Free Chapel locations, as well as Kingdom Connection International and Jentezen Franklin Media Ministries. It does not mention Free Chapel College or Free Chapel Music.

Since an auxiliary is a company subsidiary, ECFA lumps all financial information with its parent organization. While a member profile may list some auxiliaries under the “Other Names Under Which Funds May Be Raised” section, they are not all current.

For example, the only subsidiary listed under Messenger International is Messenger Rescue—a trade name formed in 2016.

The ECFA’s listings are another illustration of how the subsidiary model muddles accountability tracking. As ministries evolve and auxiliaries grow and dissolve, obtaining precise spending data is only getting more complicated.

Likely intended differently, Attorney Lentz’s saying, “What happens in the LLC, stays in the LLC,” is beginning to take on a double meaning: Without clear accountability, donors will need to dig further to learn how their donations will be stewarded—or prepare to give in blind faith.