Athlete NIL Collectives Swarm Christian Universities

Some are on shaky ground with the IRS. Here’s what’s happening at the top private Christian universities.

In June 2021, the National Collegiate Athletic Association (NCAA) adopted new rules allowing athletes to earn money from brands or other entities using their name, image, and likeness (NIL). Since then, hundreds of NIL collectives have sprung into existence, with many securing 501(c)(3) tax-exempt designations from the U.S. Internal Revenue Service (IRS) to raise contributions, develop brand partnerships, or facilitate connections and deals.

Most of the largest private Christian universities now have some sort of NIL collective, including nonprofits and for-profits, or third-party exchanges serving as official partners with the schools. These organizations usually raise funds from fans, businesses, or boosters. Then, with coordination from the collective, student-athletes sign agreements with contributors to use their name/image/likeness for any range of activities—from social media posts and brand endorsements to speeches and fundraising events to autographs and merchandise. In the case of nonprofit collectives, players might promote a partner charity.

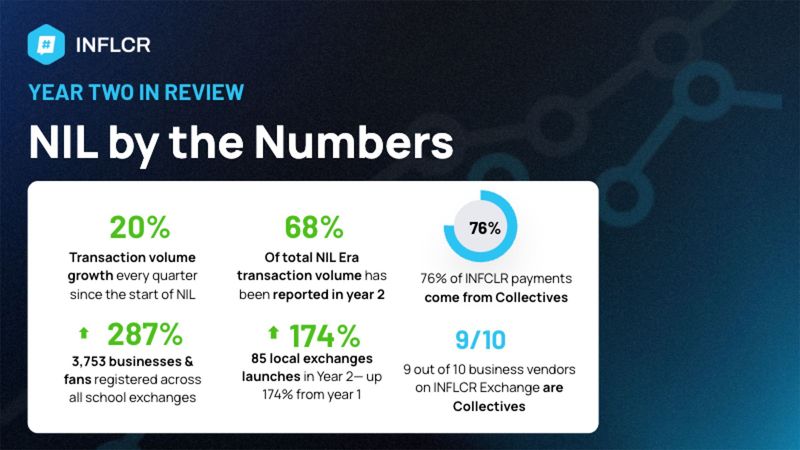

Six-figure deals are common in the NIL industry, as brands want to take advantage of players’ significant fan followings. The highest-ranked athletes have valuations from $561,000 to $5.9 million each. Opendorse, an NIL deals marketplace, projects a market spend of $1.17 billion in 2023, up from last year’s estimated $1 billion. The platform saw $917 million in deals in the first year after the NCAA implemented NIL rules. INFCLR, another NIL exchange, reported its average year-one transaction was $1,815, but year two bumped that figure to $1,936.

On the nonprofit side of the NIL business, fast growth is currently outpacing regulators’ scrutiny. 501(c)(3)-designated collectives typically advertise that they raise tax-deductible donations. This is technically true, but recent statements from the IRS suggest it might not stay that way.

Most nonprofit collectives exist in a gray area within the tax code. To meet the IRS’s requirements for tax exemption, 501(c)(3) entities must be organized and operated exclusively for the charitable purposes under which they are designated. Their net earnings should not benefit any private individual or shareholder; otherwise, the IRS may impose an excise tax for the excess benefit transaction.

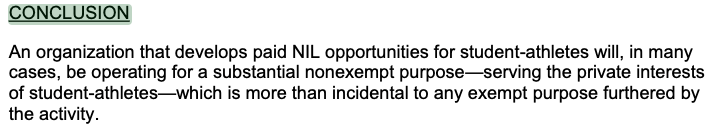

In June, the IRS published a memorandum clarifying its NIL stance: Since NIL nonprofits primarily benefit private interests rather than charitable causes, they aren’t serving the greater public and, therefore, wouldn’t qualify as tax-exempt.

(Source: Page 2)

While not binding legal precedent, the memo describes the Office of the Chief Counsel’s interpretation of how the NIL market should be treated under section 501(c)(3). It’s unclear whether NIL nonprofits will be retroactively stripped of their tax-exempt status or only subjected to stricter scrutiny.

MinistryWatch asked the IRS how it would treat past transactions and designations, but it declined to elaborate beyond the memo.

The World of Nonprofit NIL Collectives

In deals with nonprofit groups, athletes usually promote a partner charity in exchange for an NIL payout from the collective. For example, at Texas Christian University’s Flying T Club, student-athlete ambassadors can earn compensation by using their NIL to support nonprofit partners. The organization was granted 501(c)(3) tax-exempt status in mid-2022, and its latest available Form 990 indicates it generated $154,118 in revenue in 2021, the same year it was formed. More recently, a local news article from September 2022 reported it raised over $3 million from 200-plus members.

At Baylor University, a 501(c)(3) nonprofit called Startup Waco launched a partnership last year to work directly with players on promoting the organization’s work and that of its partners. It accepts tax-deductible donations through its GXG platform, which connects Baylor athletes with NIL opportunities like charity events, social media promotions, and marketing appearances. It can also help them launch a business.

The organization declined to provide updates on the number of deals GXG has facilitated. Earlier this year, a presentation to the Waco City Council stated GXG had negotiated 258 deals, averaging $7,000 to $8,000, for 206 athletes.

Many collectives take a cut of players’ earnings for administrative expenses, with some paying out 80% to 90% of the funds they receive.

Grand Canyon University’s Heart Of A Lope states that 85% of contributions go to athletes, while the rest covers IT, legal, marketing, bookkeeping, and other costs. Its donations aren’t tax-deductible yet, as the website notes it’s still seeking 501(c)(3) nonprofit status. We couldn’t find any IRS designations associated with its name, and it didn’t respond to inquiries requesting an update.

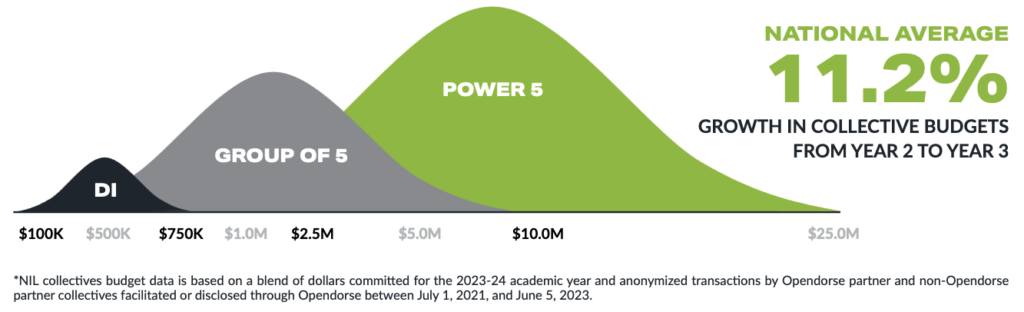

These are just a few of the 300-plus NIL groups operating nationwide. According to Opendorse, more than 200 collectives serve Division III all the way up to Power 5, where the top spenders commit upwards of $10 million annually. In the second year after NIL’s introduction, about 75% of compensation was delivered through collectives. Nearly a third have applied as 501(c)(3) nonprofits, with dozens securing the designation.

NIL collectives’ budgets in each subdivision. Source: Opendorse (page 5)

A handful of nonprofits arrived early on the scene, snagging dozens of universities as partners. Blueprint Sports, a 501(c)(3) named “BPS Foundation,” has 24 schools in its portfolio. One is High Point University, where Blueprint accepts tax-deductible donations under the Friends of HPU collective. However, the school’s student-athlete handbook states that players must disclose NIL agreements through the INFLCR On Point Exchange, which launched in 2022 as an official platform involving High Point Athletics. Neither Friends of HPU nor Blueprint are mentioned in the handbook. We asked Blueprint for clarification on its NIL activities but haven’t heard back.

Other groups follow a hybrid model with both nonprofit and for-profit arms. Liberty University’s Flames Way Collective involves two operations: Flames Way, which received 501(c)(3) designation in March 2023, accepts tax-deductible donations, while the for-profit Flames Rising LLC accepts contributions as advertising/marketing expenses for businesses.

More NIL nonprofits might explore a similar hybrid concept in the future, especially given the IRS’s recent memo suggesting it would pay closer attention to their business models. (Public tax records will reveal more once the IRS finishes processing the latest nonprofit Form 990 filings from 2022 and 2023.)

After the memo’s release, Startup Waco CEO Jon Passavant told The New York Times that the organization would move its NIL work into a for-profit subsidiary, where donations wouldn’t be tax-deductible. However, those plans haven’t materialized yet. Kailey Towns, the organization’s communications director, told MinistryWatch, “While discussions have been held around establishing GXG as a for-profit subsidiary, no formal actions have been taken and GXG currently remains as a program of Startup Waco where donations are tax-deductible.”

Other Business Models: For-Profit Groups and Third-Party Exchanges

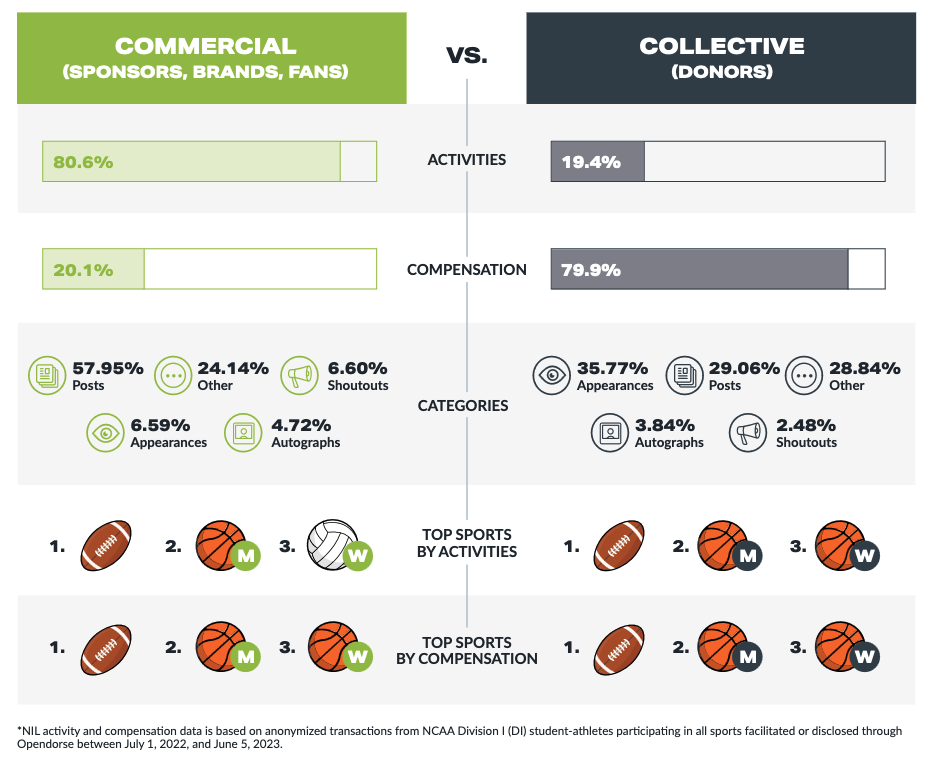

Most dollars come from donor-driven collectives, though Opendorse reports that the commercial market represents the highest volume of NIL activities driven by sponsors, brands, and fans.

Differences between collective and commercial NIL groups. Source: Opendorse (page 7)

There are several for-profit collectives at the nation’s top private Christian universities. California Baptist University’s Lance Up Collective explicitly states that it isn’t a tax-exempt entity and cannot accept donations as such. It facilitates one-time donations for individuals or membership levels for organizations/businesses. Monthly memberships span $100 to $1,500, with benefits ranging from autographed posters to social media endorsements to exclusive supporter events.

Some schools have a presence on national marketplaces like Opendorse. Baylor University’s Baylor Bears marketplace lets users buy shoutouts, appearances, or autographs, ranging from $10 to $3,840.

INFLCR is another popular third-party exchange platform, serving 3,500 college and professional teams and 90,000 athletes. Pepperdine University partnered with INFLCR last September to launch The Waves Exchange platform, which lets businesses find athletes and discuss NIL deals. Once the deal is completed, the transaction produces a direct payment, automates a disclosure to INFLCR’s Verified Compliance Ledger, and generates a 1099 tax form.

NIL activity reported to INFLCR from July 2022 to June 2023. Source: INFLCR

High Point University also uses an INFLCR portal, called On Point Exchange.

University NIL Policies

Some universities have no presence of NIL collectives and instead manage the deal disclosure process in-house with their own policies.

Vanguard University of Southern California requires disclosure and approval with its compliance office. Similarly, Anderson University runs its own in-house NIL reporting process, with disclosure policies outlined in the student-athlete handbook. Matthew Finley, deputy athletic director at Anderson, said 43 student-athletes have disclosed NIL agreements over the last three academic years.

In April, Gardner-Webb University announced interim NIL rules allowing students to earn compensation and hire professional agents to represent them for third-party endorsements, social media posts, autographs or appearances. All activities require pre-approval by athletics staff.

Gardner-Webb’s 2020-2025 Athletics Strategic Plan initially set out to create at least one NIL product offering in 2023 and expand to three products before July 2024, targeting $1,000 in annual licensing revenue. Richard McDevitt, the university’s vice president of marketing, told MinistryWatch that further NIL plans remain in development.

Main photo via Pixabay/by Foundry Co