Sens. King and Grassley Introduce Legislation to Reform Charitable Giving Through Donor-Advised Funds

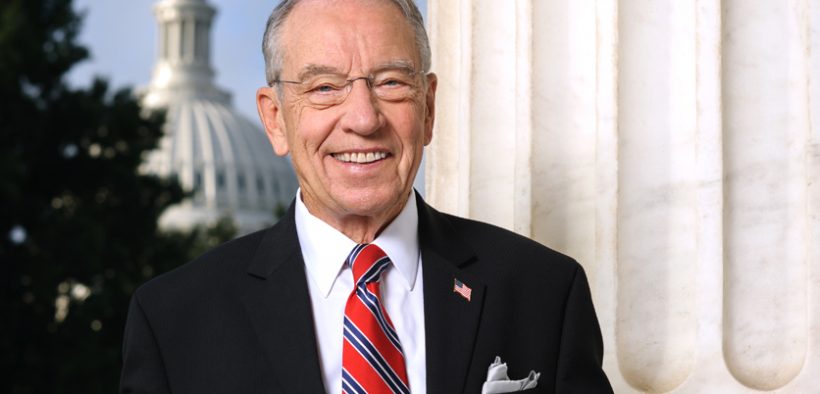

U.S. Senators Angus King (I-Maine) and Chuck Grassley (R-Iowa) have introduced legislation that would put donations in the hands of charities faster by reforming the rules surrounding donor-advised funds (DAFs).

Currently, individuals, families, and businesses that make a gift to a charity through a DAF can take an immediate tax deduction then spread out their donations over time.

The Accelerating Charitable Efforts (ACE) Act would create a new form of DAF under which a donor would get still get upfront tax benefits, but only if DAF funds are distributed or advisory privileges are released within 15 years of the donation.

The senators said there is currently more than $140 billion set aside in DAFs for future charitable gifts with no requirement of when to distribute the funds.

“Charitable dollars ought to be doing the good they were intended for, not sitting stagnant to provide tax advantages for some and management fees for others,” Sen. Grassley said.

Access to MinistryWatch content is free. However, we hope you will support our work with your prayers and financial gifts. To make a donation, click here.

Donors who want more than 15 years to distribute their DAF funds would be allowed to receive capital gains and estate tax benefits upon donation but no income tax deduction until the donated funds were fully distributed to the charitable recipient.

However, the ACE Act would allow any donor to hold up to $1 million in DAF funds at any community foundation without being subject to payout rules or amounts more than $1 million if the DAF requires a five percent annual payout or distribution within 15 years of contribution.

The legislation would also reform existing rules governing private foundations, ensuring they can’t meet payout obligations through salaries or travel expenses given to a donor’s family members or through distributions to DAFs.

“Under current rules, donor-advised funds and private foundations allow some to receive tax breaks for donations that never actually reach working charities,” Senator King said. “The ACE Act will clear up those gray areas and ensure that charitable contributions will swiftly reach the worthy organizations doing good in communities throughout the country and all over the world.”

The full legislative text for the ACE Act can be read here.